Summary

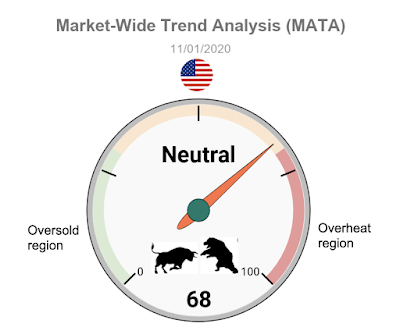

- My system's Market-Wide Trend Analysis (MATA) module has predicted this bull run in late August

- Based on MATA, current US stock market is reaching an overheated region. There is limited upside and risk of reversal is getting higher

- For Singapore stock market, the bull is still in charge but may be impacted by situation in US

- MATA analysis is shared weekly with subscribers. Get started today >>>

The bull run that began in late August last year has brought the US stock market indexes to all time high. Dow Jones touched the 29000 mark on Friday before retracing while Nasdaq is already above the 9000 mark since late December. My system's Market-Wide Trend Analysis (MATA) module has predicted this bull run in late August. The percentage rose from 40% to the current 68% and is reaching the overheated region. This means that the market has limited upside and the risk of reversal grows higher as the percentage gets towards and over the 70% mark. In fact the value has been hovering round 68% for the past two weeks while the indexes continue to rise.

What about Singapore stock market? MATA also predicted the mini bull run in Singapore stock market that started in late August. MATA percentage rose from 29% to the current 39%. The bull is still in charge for now as there is still a lot of leg space for upward movement. Despite that, as Singapore market is quite sensitive to things happening in US, any reversal in US will surely have an impact on Singapore.

Follow us on Facebook!

Get Full Access and follow our system's quest for ABNORMAL returns

Performance Join as Member

![[Watchlist] US Stocks caught Trending on System's Radar for Week of 17th Sep 2018](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjVlw8ePzHYbUGgNe8-I-gEMvS7StYEclF_E7lAhUHjHAXuTh1bUMXAt6Zg1o0qEFZfwIkS7__E3zVLFnLecU05bRmfsVTIxBqnwAsXocCDYCMCKYT3rXnPacIuEnANSsBQV6kHgPYQa8he/s72-c/stock-market-2616931_640.jpg)

![[Watchlist] US Stocks caught Trending on System's Radar for Week of 27th Aug 2018](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhld7TDTlKp433twtL0Ha0L_Aky2PiMKIJCcjTHgd4gZ0AUcAx1Y0R0c4NkdGA8Zru5eDEU4Mnfa2786NG_5UEfTqI2Hh4GQG6gai8q4XeNDMSlKb51xm-O7VwmhIevASVx62B5IC2drPM4/s72-c/stocklist1.jpeg)

No comments:

Post a Comment