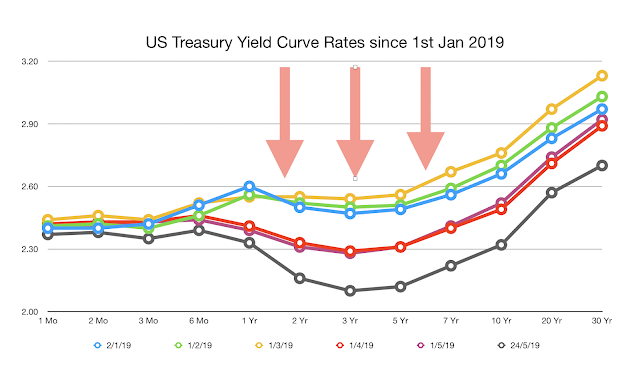

> We are now Very Close to a Yield Curve Inversion. We talked about this about A Year Ago.

You can also read below post that explains what is yield curve inversion and the significance it holds in modern economy.

In short, when the short term funds become more expensive then the long term ones, the banks will have less incentives to do what they called maturity transformation, which is to borrow short term and lend long term. This tightening in leading by the banks would mean slowing of economic activities since loans are not easily available to businesses anymore.

Based on my analysis using the 10-yr to 1-yr curve, 7 out of 8 times after the yield curve inverts, within the next 1.5 years, there will be a stock market crash. Looking at the current situation, it seems inevitable that the yield curve will continue to flatten as seen in the chart below that display the treasury rates of different maturities as it progresses from the start of 2019. Anyway, the countdown has started 2 months ago.

Is DIYQuant prepared for a market crash?

Since the beginning of May, DIYQuant system has been offloading stocks from its portfolios and went overweight in cash. In fact, the US portfolio is currently 90% in cash while Singapore portfolio is 50% in cash. Hence if the market continues to weaken, the portfolio will be well protected from the turmoil. All thanks to the system's MATA module whose job is to anticipate market wide trend reversal which is more accurate and granular than the yield curve inversion indicator (check out MATA details at the strategy page).

Get Full Access and follow our system's quest for ABNORMAL returns

Performance Join as Member

Follow our blog on Facebook!

![[Watchlist] US Stocks caught Trending on System's Radar for Week of 17th Sep 2018](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjVlw8ePzHYbUGgNe8-I-gEMvS7StYEclF_E7lAhUHjHAXuTh1bUMXAt6Zg1o0qEFZfwIkS7__E3zVLFnLecU05bRmfsVTIxBqnwAsXocCDYCMCKYT3rXnPacIuEnANSsBQV6kHgPYQa8he/s72-c/stock-market-2616931_640.jpg)

![[Watchlist] US Stocks caught Trending on System's Radar for Week of 27th Aug 2018](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhld7TDTlKp433twtL0Ha0L_Aky2PiMKIJCcjTHgd4gZ0AUcAx1Y0R0c4NkdGA8Zru5eDEU4Mnfa2786NG_5UEfTqI2Hh4GQG6gai8q4XeNDMSlKb51xm-O7VwmhIevASVx62B5IC2drPM4/s72-c/stocklist1.jpeg)

No comments:

Post a Comment