STI gained a nice 5.85% in April as it broke pass 2 major resistances in a single month. The sentiments in April was generally upbeat as US and China continue to move along positively in the trade talk, US corporate earnings remain healthy and DBS (a major component of the STI) posted solid earning for 2018.

How was the portfolio performance in April?

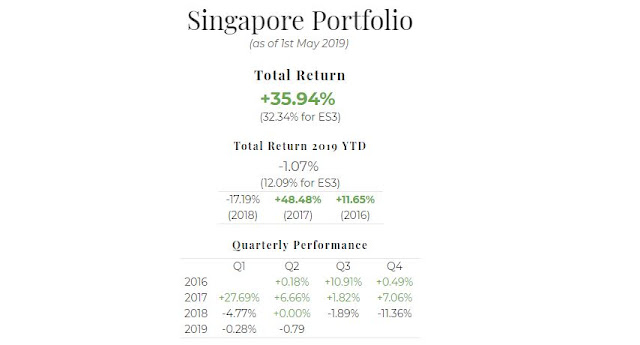

My system's SG portfolio made a slight loss of 0.79% this month as one of the stock in the portfolio China Everbright made a 12% loss on the last trading of the month and thus pulled the portfolio into the reds again despite the great performance of Penguin Intl which has risen 12.50%. Fortunately again, position sizing saved the portfolio from large drawdowns - the same advice, never put all the eggs into one basket. In addition, patience is crucial here. Despite having several consecutive red quarters, I will still continue to follow the strategy and trading rules strictly and systematically, while patiently waiting for profit to return as this strategy has been backtested to outperform the market in the long run. That is one of the most important rule of systematic trading.

Total return since inception fell slightly to +35.94%.

April return: -0.79% (ES3: +6.22%)

Total return since inception (since June 2016): +35.94%.

The system has been bullish since February 2019. However, despite the huge run-up of STI in April, the overall market sentiments has plateaued since April. The adage 'sell in May and go away' could be a potential risk to the market. We will have to monitor closely because if the market reverses, it could happen pretty fast. To know first hand where the market is heading every week, subscribe to our subscription package. Visit our main page to find out more.

Get Full Access and follow our system's quest for ABNORMAL returns

Performance Join as Member

Follow our blog on Facebook!

![[Watchlist] US Stocks caught Trending on System's Radar for Week of 17th Sep 2018](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjVlw8ePzHYbUGgNe8-I-gEMvS7StYEclF_E7lAhUHjHAXuTh1bUMXAt6Zg1o0qEFZfwIkS7__E3zVLFnLecU05bRmfsVTIxBqnwAsXocCDYCMCKYT3rXnPacIuEnANSsBQV6kHgPYQa8he/s72-c/stock-market-2616931_640.jpg)

![[Watchlist] US Stocks caught Trending on System's Radar for Week of 27th Aug 2018](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhld7TDTlKp433twtL0Ha0L_Aky2PiMKIJCcjTHgd4gZ0AUcAx1Y0R0c4NkdGA8Zru5eDEU4Mnfa2786NG_5UEfTqI2Hh4GQG6gai8q4XeNDMSlKb51xm-O7VwmhIevASVx62B5IC2drPM4/s72-c/stocklist1.jpeg)

No comments:

Post a Comment