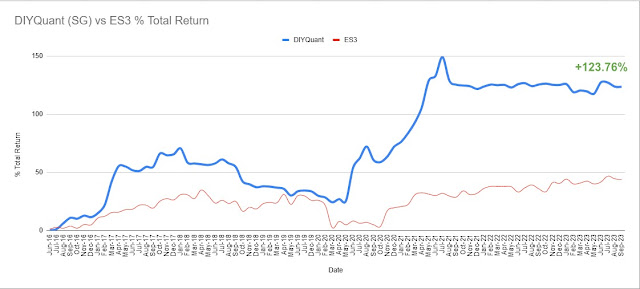

So far this year, my SG portfolio return didn't change much despite the weak performance of small capital stocks due to the high interest environment. The portfolio year-to-date return so far stood at -0.71% and has been heavyweight in cash for most part of the year (technically I should add another +2-3% as most of the cash are placed in T-Bills and Fixed deposit). Overall return since inception remained at +123.76%, still way ahead of STI benchmark for the same period.

Moving into the last quarter of 2023, I expect the portfolio to maintain a high cash component as long as the interest rate remains elevated.

To know exactly what stocks the system is buying, subscribe to our premium subscription package. Visit our main page to find out more about the system's performance.

Performance Join as Member

Like us on Facebook!

![[Watchlist] US Stocks caught Trending on System's Radar for Week of 17th Sep 2018](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjVlw8ePzHYbUGgNe8-I-gEMvS7StYEclF_E7lAhUHjHAXuTh1bUMXAt6Zg1o0qEFZfwIkS7__E3zVLFnLecU05bRmfsVTIxBqnwAsXocCDYCMCKYT3rXnPacIuEnANSsBQV6kHgPYQa8he/s72-c/stock-market-2616931_640.jpg)

![[Watchlist] US Stocks caught Trending on System's Radar for Week of 27th Aug 2018](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhld7TDTlKp433twtL0Ha0L_Aky2PiMKIJCcjTHgd4gZ0AUcAx1Y0R0c4NkdGA8Zru5eDEU4Mnfa2786NG_5UEfTqI2Hh4GQG6gai8q4XeNDMSlKb51xm-O7VwmhIevASVx62B5IC2drPM4/s72-c/stocklist1.jpeg)

No comments:

Post a Comment