The auction result for BY23102N 1-Year T-bill has just been released in the MAS website here with a cut-off yield of 3.74% p.a. This is higher than the previous one BY23101W in April which was 3.58% p.a. The next 1 year T-bill will be announced on 12 Oct 2023.

The TBills, or Treasury Bills, are short-term debt instruments issued by the government to raise funds. They are considered one of the safest investments as they are backed by the full faith and credit of the government. Investors often use TBills as a low-risk option for preserving capital and earning a modest return.The results provided indicate the outcomes of a recent TBills auction.

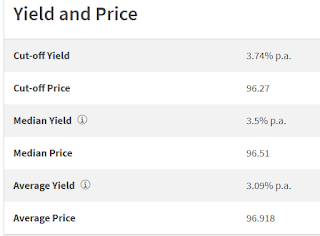

Break down of the key metrics of the current results:

1. Cut-off Yield 3.74% p.a.:

This is the highest yield accepted at the auction. The cut-off yield represents the interest rate at which the government sells TBills to investors who bid at or above this rate.

2. Cut-off Price 96.27:

The cut-off price refers to the price at which TBills are sold to investors who bid at or above the cut-off yield. In this case, it is 96.27, which means investors willing to accept a yield of 3.74% or higher were awarded the TBills at this price.

3. Median Yield 3.5% p.a.:

The median yield is the middle value of all accepted bids. It indicates that half of the successful bidders accepted a yield below 3.5% and the other half accepted a yield above this rate.

4. Median Price 96.51:

The median price represents the price at which the TBills were sold to investors whose bids were at the median yield. In this case, it is 96.51.

5. Average Yield 3.09% p.a.:

The average yield is the sum of all accepted yields divided by the total number of successful bids. It provides an overall picture of the auction results and the prevailing interest rate at which the majority of the TBills were sold.

6. Average Price 96.918:

The average price is the sum of all accepted prices divided by the total number of successful bids. It gives an average value of the prices at which the TBills were sold.

Overall, the results suggest that the TBills auction was relatively successful, with a mix of investors accepting various yields and prices. The cut-off yield of 3.74% indicates that some investors were willing to accept a higher interest rate for the safety of investing in government-backed securities. The median and average yields being lower than the cut-off yield may suggest that many investors accepted lower returns for the security and liquidity offered by TBills. Similarly, the median and average prices being higher than the cut-off price indicate that most investors paid a premium to purchase these safe assets.

It's important to note that TBills' yields and prices can be influenced by various factors, including prevailing interest rates, economic conditions, and investor sentiment. As short-term instruments, TBills' yields are generally lower than longer-term bonds, but they play a crucial role in the financial markets as a benchmark for other interest rates and as a safe haven for investors during uncertain times.

To know exactly what stocks the system is buying, subscribe to our premium subscription package. Visit our main page to find out more.

Performance Join as Member

Like us on Facebook!

![[Watchlist] US Stocks caught Trending on System's Radar for Week of 17th Sep 2018](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjVlw8ePzHYbUGgNe8-I-gEMvS7StYEclF_E7lAhUHjHAXuTh1bUMXAt6Zg1o0qEFZfwIkS7__E3zVLFnLecU05bRmfsVTIxBqnwAsXocCDYCMCKYT3rXnPacIuEnANSsBQV6kHgPYQa8he/s72-c/stock-market-2616931_640.jpg)

![[Watchlist] US Stocks caught Trending on System's Radar for Week of 27th Aug 2018](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhld7TDTlKp433twtL0Ha0L_Aky2PiMKIJCcjTHgd4gZ0AUcAx1Y0R0c4NkdGA8Zru5eDEU4Mnfa2786NG_5UEfTqI2Hh4GQG6gai8q4XeNDMSlKb51xm-O7VwmhIevASVx62B5IC2drPM4/s72-c/stocklist1.jpeg)

No comments:

Post a Comment