Welcome 2022 and bye bye 2021. 2021 saw another year of good performance for DIYQuant's system despite the on-going pandemic with the country trying to keep the virus in check and learn to live with it. Overall the stock market did well too for 2021 with STI managed to rebound and close to erasing previous year's loss.

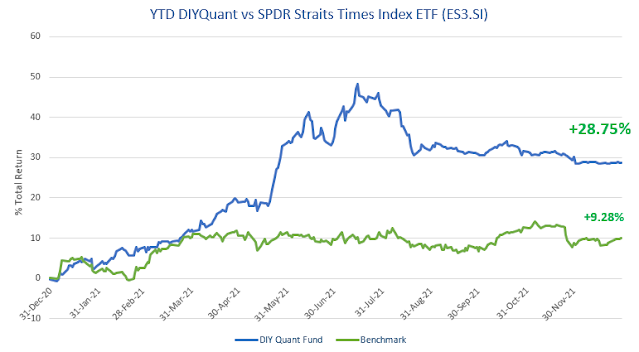

Here is my SG portfolio return for the year 2021.

2021 return: +28.75% (vs ES3 +9.28%)

Total return since inception (June 2016) +121.91% (vs ES3 +27.86%)

Here is the SG performance chart since inception as compared to benchmark SPDR Straits Times Index ETF (ES3.SI)

Here is the SG performance vs ES3 for 2021Singapore Momentum

(as of 31st Dec 2021)Total Return

+121.91%(+27.86% for ES3 since Jun 2016)

Yearly Returns

+28.75% (2021)(+9.28% for ES3)

| +29.11% (2020) | -2.85% (2019) | -17.19% (2018) | +48.48% (2017) | +11.65% (2016) |

4 multibaggers in total!

System had 3 multibaggers in SG portfolio and 1 in US portfolio.

In 2020, SG has 1 multibagger. This year, SG has 3 new multibaggers. PropNex (OYY.SI) +170.87%, Del Monte (D03.SI) +130.52% and Union Gas (1F2.SI) +102.40%. US has 1 multibagger same as last year but this year's multibagger is a big one (Entravision EVC +250.00%), second highest so far since inception.

In total. close to 30 stocks were traded for SG in 2021. Average return for each stock is +12.21% which is quite significant but it is also skewed by the few multi-baggers pushing the average up. The percentage of profitable trade vs losing trade is around 60% (ie 0.6 probability of trade is profitable)

Here are the top 5 SG stocks that were transacted in 2021.

1. PropNex (OYY.SI) Oct 2020 - Sep 2021 +170.87%

2. Del Monte (D03.SI) Dec 2020) - Aug 2021 +130.52%

3. Union Gas (1F2.SI) Oct 2020 - Aug 2021 +102.40%

4. APAC Realty (CLN.SI) May 2021 - May 2021 +20.95%

5. Sunpower (5GD.SI) Nov 2020 - Mar 2021 +14.84%

Here are the bottom 5 SG stocks that were transacted in 2021.

1. OKH Global (S3N.SI) Nov 2021 - Nov 2021 -17.24%

2. IFast Corp (AIY.SI) Sep 2021 - Oct 2021 -8.87%

3. Mapletree NCT (RW0U.SI) Apr 2021 - May 2021 -6.42%

4. Lian Beng (L03.SI) Aug 2021 - Sep 2021 -5.66%

5. Geo Energy (RE4.SI) Oct 2021 - Nov 2021 -5.63%

Follow us in our quest for abnormal return. Join us today >>>

US portfolio did very well for the first 3 quarters but slid in the last quarter to end below the SPY benchmark. Here is my US portfolio return for the year 2021.

2021 return: +17.98% (vs SPY+28.73%)

Total return since inception (June 2016) +118.32% (vs SPY +151.33%)

US Momentum

(as of 31st Dec 2021)Total Return

+118.32%(+151.33% for SPY since Jun 2016)

Yearly Returns

+17.98% (2021)(+28.73% for SPY)

| +14.29% (2020) | -3.84% (2019) | -2.47% (2018) | +45.85% (2017) | +19.35% (2016) |

In total, similar to SG, close to 30 stocks were traded in 2021 for US portfolio. Average return for each stock is +10.81% which is also skewed by the few high return stocks pushing the average up. The percentage of profitable trade vs losing trade is around 50%. Generally, US stocks are more volatile compared to SG.

Here are the top 5 US stocks that were transacted in 2021.

1. EVC (Oct 2020 - Nov 2021) +250.00%

2. NRT (Mar 2021) - Nov 2021) +86.40%

3. AWX (Nov 2020 - Msr 2021) +66.65%

4. RJI (Nov 2020 - Dec 2021) +40.48%

5. MIE (Feb 2021 - Aug 2021) +35.01%

Here are the bottom 5 US stocks that were transacted in 2021.

1. FEDU (Nov 2021 - Dec 2021) -31.52%

2. LUB (Sep 2021) - Nov 2021) -31.13%

3. GLDG (Nov 2021 - Nov 2021) -17.09%

4. VNRX (Nov 2021 - Nov 2021) -16.03%

5. ORLA (Nov 2021 - Dec 2021) -15.37%

DIYQuant bought some gold

I took some profit and divested into gold. Not the gold miner stock or ETF, it is the real physical gold which can be bought from UOB. If you have read my last year's end of year report, I mentioned that I have already paid off my mortgages which is my final debt on hand. So it is time to diverse into some other less risky asset class. Some say I should have bought Bitcoins which is deems as the new gold. Nah, since it for diversification and to keep for long term, I still prefer something I can touch and has been deemed worthy for a long time. Even if the whole internet world are to go down, I will still have my gold.

Trading becomes harder as the total capital grows

Actually, it is a good problem. Now that my portfolio has more than doubled, the amount invested in each stock need to be doubled assuming total reinvestment of profit (theoretically). It is not easy when it comes to low volume stocks or penny stocks. One way is to increase the maximum number of stocks the portfolio can hold or extend the strategy to some other markets (eg HKSE).

Side hustle has taken most of my time in 2021

By right, side hustle should be as per what the name implies, a side hustle. But this year, my this side hustle (not related to trading/investing though) is taking away most of my time. Despite the lucrative remuneration, it is taking a toll on me and I am not sure if this can sustain in the long run. Fortunately, I have someone to help manage the system. And with system trading, there is no need to really do any research on stocks. It is to simply following what the system buy and sell.

Crystal-balling attempt for 2022

Now that 2021 is over, next is my attempt to forecast what could be in store in 2022 based on system's analysis. Take note that the system is designed to be risk averse, meaning it will carry an umbrella whenever there is dark cloud in the horizon. As of this writing, the system is close to 100% cash. It came to me as a surprise as well, given that STI did rather well and SPY recently hit all time high. But given now that the Feds are dialing back on the easy money policy due to the rising inflation and is planning to increase rates starting early next year, it seems reasonable to be on risk off mode for the time. And I always listen to my system... trade with care.

Follow us on Facebook!Follow us via Email!

![[Watchlist] US Stocks caught Trending on System's Radar for Week of 17th Sep 2018](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjVlw8ePzHYbUGgNe8-I-gEMvS7StYEclF_E7lAhUHjHAXuTh1bUMXAt6Zg1o0qEFZfwIkS7__E3zVLFnLecU05bRmfsVTIxBqnwAsXocCDYCMCKYT3rXnPacIuEnANSsBQV6kHgPYQa8he/s72-c/stock-market-2616931_640.jpg)

![[Watchlist] US Stocks caught Trending on System's Radar for Week of 27th Aug 2018](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhld7TDTlKp433twtL0Ha0L_Aky2PiMKIJCcjTHgd4gZ0AUcAx1Y0R0c4NkdGA8Zru5eDEU4Mnfa2786NG_5UEfTqI2Hh4GQG6gai8q4XeNDMSlKb51xm-O7VwmhIevASVx62B5IC2drPM4/s72-c/stocklist1.jpeg)

No comments:

Post a Comment