Finally managed to find some time to write the January 2022 performance report. I have been busy the last few days with Chinese New Year visits. SG stock market started the year with a bang with STI rising 5% in a month as we usher in the year of the tiger. Despite the sell-offs in the US market, especially the big techs, SG market remained unfazed. As the STI index is heavily weighted by our 3 big local banks, rising interest rates has been good for it so far.

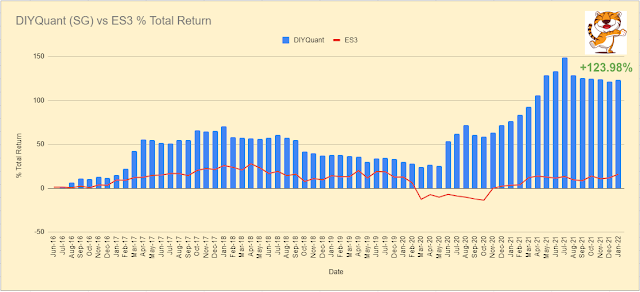

My system's SG portfolio managed to eke out a 1.7% return in January. Total return since inception is now +123.98% while SGX:ES3 (STI ETF benchmark for comparison) returned merely +16.13% for the same period. Despite the strong index performance in January, its total return still dwarfed by my system's total return.

Join us in our quest for abnormal returns. Get started today >>

Below is the chart showing the SG portfolio's monthly return since inception.

On the US side, the sell-offs in January has also somewhat impacted my system's US portfolio. Fortunately the system was on average around 80% cash throughout the month. The huge cash amount cushioned the fall. The SPY fell 8.76% in January while my system's US portfolio fell 4.60%. So other than beating the market by gaining more, the other way is to lose less. Losing less will also help in improving the beta of the portfolio.

Below is the chart showing the US portfolio's monthly return since inception.

Based on systems overall market analysis, the SG market will remain muted in February. The January and Chinese New Year effects are over. SG market may be more impacted by the weakness in US market due to the quantitative tightening. I believe we will see more weakness in the market as we approach the first rate hike in more than 2 years.

To know exactly what stocks the system is buying, subscribe to our premium subscription package. Visit our main page to find out more.

Performance Join as Member

Like us on Facebook!

![[Watchlist] US Stocks caught Trending on System's Radar for Week of 17th Sep 2018](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjVlw8ePzHYbUGgNe8-I-gEMvS7StYEclF_E7lAhUHjHAXuTh1bUMXAt6Zg1o0qEFZfwIkS7__E3zVLFnLecU05bRmfsVTIxBqnwAsXocCDYCMCKYT3rXnPacIuEnANSsBQV6kHgPYQa8he/s72-c/stock-market-2616931_640.jpg)

![[Watchlist] US Stocks caught Trending on System's Radar for Week of 27th Aug 2018](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhld7TDTlKp433twtL0Ha0L_Aky2PiMKIJCcjTHgd4gZ0AUcAx1Y0R0c4NkdGA8Zru5eDEU4Mnfa2786NG_5UEfTqI2Hh4GQG6gai8q4XeNDMSlKb51xm-O7VwmhIevASVx62B5IC2drPM4/s72-c/stocklist1.jpeg)

Thanks for sharing this post keep posting.

ReplyDeleteDLF share price