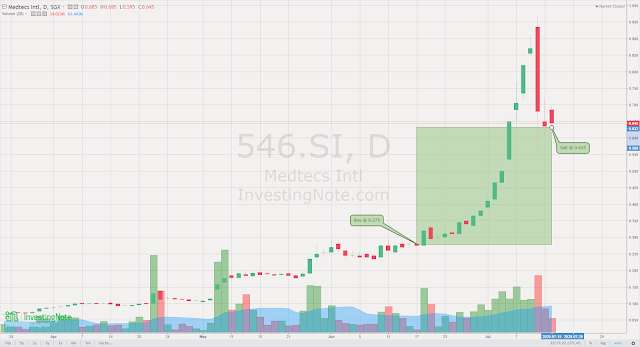

Recently, there have been several small cap stocks that are in parabolic ascend despite the weak economy we are experiencing (by the way, Singapore just entered technical recession if you are still not aware). The system managed to catch a few, especially those in healthcare sector. I mentioned some of those in my June performance report. The one that was unloaded today was Medtecs (SGX:546). System gave a buy signal in mid June when the stock was just trading around 0.275.

For the following few weeks, it was in supercharge mode, rising parabolically with more than 80% of the days in green. At one point my unrealized profit was more than 200%. Then last few days, it began to sell-off for whatever reason. The stock has weakened. It hit my stoploss and I unloaded today at 0.635 with a total profit of 130.91%.

A multibagger this is. Pretty awesome profit for just a holding period of close to a month. But still not able to beat my AEM position (+247.18% profit) in 2016. It also reminds me of another healthcare stock that the system managed to catch in April 2020. Biolidics Limited (SGX:8YY) - fast in, fast out, fast profit.

Join us in our quest for abnormal returns. Get started today >>

I deem such stocks as highly volatile and risky as you can see the recent plummet of Medtecs. In fact it happened before (at a smaller scale) in January. So trading in such stocks requires great discipline especially in adhering to the selling plan, in my case, adhering to the stoploss. I make use of my system to keep my plan and emotion in check. When it says sell, I'll sell. No question asked. It also helps me to manage my risk by not putting too much capital into one single stock (which is referred to as concentration risk).

Most importantly, do your own due diligence.

Follow us on Facebook!

Get Full Access and follow our system's quest for ABNORMAL returns

Performance Join as Member

![[Watchlist] US Stocks caught Trending on System's Radar for Week of 17th Sep 2018](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjVlw8ePzHYbUGgNe8-I-gEMvS7StYEclF_E7lAhUHjHAXuTh1bUMXAt6Zg1o0qEFZfwIkS7__E3zVLFnLecU05bRmfsVTIxBqnwAsXocCDYCMCKYT3rXnPacIuEnANSsBQV6kHgPYQa8he/s72-c/stock-market-2616931_640.jpg)

![[Watchlist] US Stocks caught Trending on System's Radar for Week of 27th Aug 2018](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhld7TDTlKp433twtL0Ha0L_Aky2PiMKIJCcjTHgd4gZ0AUcAx1Y0R0c4NkdGA8Zru5eDEU4Mnfa2786NG_5UEfTqI2Hh4GQG6gai8q4XeNDMSlKb51xm-O7VwmhIevASVx62B5IC2drPM4/s72-c/stocklist1.jpeg)

No comments:

Post a Comment