How was June 2020 like for Singapore market?

SG market was generally well supported in the month of June like what I have mentioned during last month's report. Sentiments was quite bullish in the beginning of the month with STI rose from 2500ish to momentarily above 2800. However it then fell sharply in mid June and currently hovering around 2600. Singapore has exited its circuit breaker and is now in Phase 2 of re-opening, with the general election around the corner. Despite the sharp fall in mid June, STI still managed to garner a 3.15% return for the month.

How was the portfolio performance in June 2020?

My SG portfolio performed quite well in June. It managed to record a whopping +22.16% gain in a single month. while ES3 (the STI ETF benchmark I used to compare) only rose 3.60%, thus the portfolio still beats the benchmark by a huge margin. The sharp gain this month was attributed to several healthcare small caps that the system managed to catch before their crazy parabolic rise started. One of it is Singapore eDevelopment Limited (40V.SI) which is currently sitting on a +95.00% unrealized gain and the other one is Synagie Corporation Ltd. (V2Y.SI) with a +45.53% unrealized gain. There are a few others which I can only share with my subscribers. Take note all these are healthcare small caps and individually they could be quite risky. Hence to mitigate risk (as much as possible without limiting performance too much) the system splits the capital into many chucks with each chuck investing at most 15% of total capital in a single stock. Take note also that most of these are unrealized gain so there is a chance that it will be all gone the next day if they all decide to sell-off together. It could be the other way as well, all rise together.

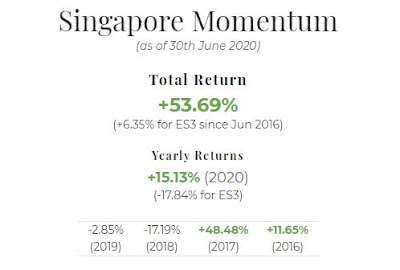

Year-to-date return rose to +15.13% while ES3 is still in the red at -17.94%. Total return since inception in June 2016 is now +53.69%. while ES3 has only increased 6.35% for the same period.

Join us in our quest for abnormal returns. Get started today >>

June return: +22.16% (vs ES3: +3.60%)

YTD return: +15.13% (vs ES3: -17.94%)

Total return since inception (since June 2016): +53.69% (vs ES3: +6.35%)

I have been really busy in June and would continue to be so in July (and probably August as well) so I haven't been really focusing on my investment. You don't see me actively posting in this blog recently as well. I would simply just execute trades according to what the system signaled. But that is exactly what system trading is all about - just follow what they system tells you.

Anyway, moving into July, I would expect the overall market trend to continue to be well supported. The system is likely to continue to remain bullish for SG market. To know first hand where the market is heading every week, subscribe to our premium subscription package. Visit our main page to find out more.

Get Full Access and follow our system's quest for ABNORMAL returns

Performance Join as Member

Follow our blog on Facebook!

![[Watchlist] US Stocks caught Trending on System's Radar for Week of 17th Sep 2018](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjVlw8ePzHYbUGgNe8-I-gEMvS7StYEclF_E7lAhUHjHAXuTh1bUMXAt6Zg1o0qEFZfwIkS7__E3zVLFnLecU05bRmfsVTIxBqnwAsXocCDYCMCKYT3rXnPacIuEnANSsBQV6kHgPYQa8he/s72-c/stock-market-2616931_640.jpg)

![[Watchlist] US Stocks caught Trending on System's Radar for Week of 27th Aug 2018](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhld7TDTlKp433twtL0Ha0L_Aky2PiMKIJCcjTHgd4gZ0AUcAx1Y0R0c4NkdGA8Zru5eDEU4Mnfa2786NG_5UEfTqI2Hh4GQG6gai8q4XeNDMSlKb51xm-O7VwmhIevASVx62B5IC2drPM4/s72-c/stocklist1.jpeg)

No comments:

Post a Comment