How was July like for Singapore market?

After the extravagant rise in June, STI traded in a range for the month of July. The index rose earlier in the month after news that US and China agreed to resume trade talks after the G20 summit. Subsequently market continued its ascend after the US Fed's hinted on a rate cut at the end of the month to spur the sluggish economy. However, the market rise had been pressured by the gloomy Singapore economy outlook and the risk of entering a technical recession. Then on the last day of the month, STI fell 1.49% after news that the US China trade talk in Shanghai ended with no progress. For the month of July, STI fell a slight 0.63%.

How was the portfolio performance in July?

My SG portfolio rose a slight 0.51% and thus beat STI by a slight margin this month. The portfolio was heavyweight in REITs in July but the bulk of the return came from the privatization offer of HMI (SGX:588) that made me a profit of 12.50%.

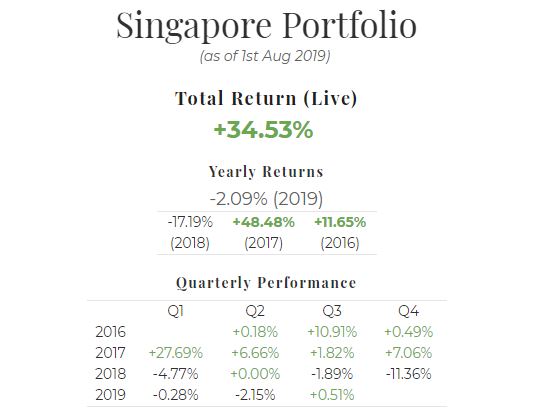

Total return since inception rose slightly to +34.53%..

July return: +0.51% (vs ES3: -0.36%)

YTD return: -2.10% (vs ES3: +10.02%)

Total return since inception (since June 2016): +34.53% (vs ES3: +30.60%)

In my last month's report, I mentioned that I was not expecting a huge rally in July as MATA percentage is not moving much. True enough, STI traded in a range and eventually gave up all its gains in the last day of the month. Moving into August, based on MATA percentage, it appears that SG market is still well supported at this level and the upcoming National Day will probably be able to give the market a little boost. The rest will depend on external factors such as how the market react to the US Fed's rate cut and trade war between US and China. To know first hand where the market is heading every week, subscribe to our premium subscription package. Visit our main page to find out more.

Get Full Access and follow our system's quest for ABNORMAL returns

Performance Join as Member

Follow our blog on Facebook!

![[Watchlist] US Stocks caught Trending on System's Radar for Week of 17th Sep 2018](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjVlw8ePzHYbUGgNe8-I-gEMvS7StYEclF_E7lAhUHjHAXuTh1bUMXAt6Zg1o0qEFZfwIkS7__E3zVLFnLecU05bRmfsVTIxBqnwAsXocCDYCMCKYT3rXnPacIuEnANSsBQV6kHgPYQa8he/s72-c/stock-market-2616931_640.jpg)

![[Watchlist] US Stocks caught Trending on System's Radar for Week of 27th Aug 2018](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhld7TDTlKp433twtL0Ha0L_Aky2PiMKIJCcjTHgd4gZ0AUcAx1Y0R0c4NkdGA8Zru5eDEU4Mnfa2786NG_5UEfTqI2Hh4GQG6gai8q4XeNDMSlKb51xm-O7VwmhIevASVx62B5IC2drPM4/s72-c/stocklist1.jpeg)

No comments:

Post a Comment