But even if backtesting results are great, it does not mean it will work well in the future.

I get this response a lot. My standard reply would be if you do not backtest, how do you know if your strategy would work then?. Do you believe it works simply because someone vouched for it? Then how do you know exactly how that person is trading his strategy? What if he doesn't tell you the whole story? What if it only works for a certain period like only during the bull market? To me, not testing a strategy is as good as doing guessing in your trading. Backtesting results may not guarantee that future performance will match, but it at least tells you that the strategy works in the past and if good data and sufficient timeframe is used for the backtest, there is a high likelihood that it will perform well in the future. There are certain factors that may skew the future performance such as overfitting, testing bias, crappy historical data, too short a timeframe, among others but all these can be addressed and there are ways to minimise it but I shall not discuss it further in this post.

In addition, backtesting gives you the confidence to trade the system even in times where the system is experiencing a losing streak. It prevents you from doubting your own strategy as you know that in the long run, the strategy works. Without this confident and assurance, it is easy for you to waver and start ditching the strategy for another the moment it starts to lose money. And you will be moving from strategy to strategy and this is as good as having no strategy.

Ok, backtesting is necessary but how can I trust YOUR backtesting?

DIYQuant trading model was first tested using US stock market historical data. We used the historical data provided by Quantopian for backtesting the DIYQuant trading model. The reason to use Quantopian is because the data is more reliable and trusted by many as it is meant for developing quant trading systems to be sent for competition. (so that no one will accuse us of scamming!). A similar trading model was then tested in Singapore market. Both produced phenomenal returns.

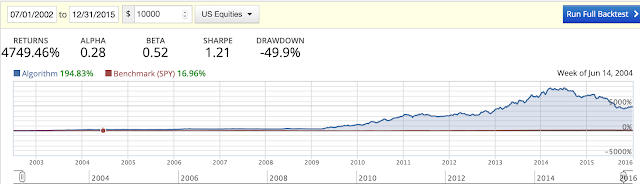

US Portfolio Simulation.

Below is the performance of the system running from 2002 to 2015. It is interesting to note that the beta is only 0.52 which means it is only half as volatile as the benchmark SPY but still beat it with an alpha of 0.28!

Check out this video that captures the simulation running in Quantopian from 2002 to 2015.

Yearly Returns 2002 - 2015 (Backtest)

+4749.47%

| -30.95% (2015) | -4.19% (2014) |

+71.94% (2013) | +41.97% (2012) | -5.00% (2011) |

| +142.00% (2010) | +195.00% (2009) | +3.00% (2008) | +1.00% (2007) | +21.00% (2006) |

| +9.08% (2005) | +20.92% (2004) | +158.47% (2003) | +2.40% (2002) |

Singapore Portfolio Simulation.

For Singapore portfolio the trading model is run using historical data curated from Yahoo Finance, Google Finance and other sites. Below is the performance of the system running from 2002 to 2015.Yearly Returns 2002 - 2015 (Backtest)

+5073.70%

| +70.81% (2015) | +21.79% (2014) | +67.60% (2013) | +1.26% (2012) |

+15.24% (2011) |

| +17.01% (2010) | +68.72% (2009) | -25.76% (2008) | +92.49% (2007) | +59.24% (2006) |

| +12.97% (2005) | +32.77% (2004) | +53.85% (2003) | +20.24% (2002) |

Ok, you have a great backtest results, how did the system fare in live trading?

In addition to the great backtesting results, the system performance has been phenomenal so far in live trading. The system has been trading live since June 2016 and so far, the annual returns are well within the model as displayed in below table. Take note that calculation of the performance is based on absolute return.

US Portfolio

| -2.47% (2018) | +45.85% (2017) | +19.35% (2016) |

Singapore Portfolio

| -17.19% (2018) | +48.48% (2017) | +11.65% (2016) |

* To see the latest performance of the system which includes the total returns and quarterly returns, please visit the main page. The results are updated every month.

Get Full Access and follow our system's quest for ABNORMAL returns

Performance Join as Member

Follow our blog on Facebook!

![[Watchlist] US Stocks caught Trending on System's Radar for Week of 17th Sep 2018](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjVlw8ePzHYbUGgNe8-I-gEMvS7StYEclF_E7lAhUHjHAXuTh1bUMXAt6Zg1o0qEFZfwIkS7__E3zVLFnLecU05bRmfsVTIxBqnwAsXocCDYCMCKYT3rXnPacIuEnANSsBQV6kHgPYQa8he/s72-c/stock-market-2616931_640.jpg)

![[Watchlist] US Stocks caught Trending on System's Radar for Week of 27th Aug 2018](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhld7TDTlKp433twtL0Ha0L_Aky2PiMKIJCcjTHgd4gZ0AUcAx1Y0R0c4NkdGA8Zru5eDEU4Mnfa2786NG_5UEfTqI2Hh4GQG6gai8q4XeNDMSlKb51xm-O7VwmhIevASVx62B5IC2drPM4/s72-c/stocklist1.jpeg)

No comments:

Post a Comment