STI went back to where it started this year at the close on Friday, but inclusive of dividend, the return is 3.68%. Not too bad as compared to the US market which has already well into the bear territory, The reason has been the same for the past 1 year - inflation.

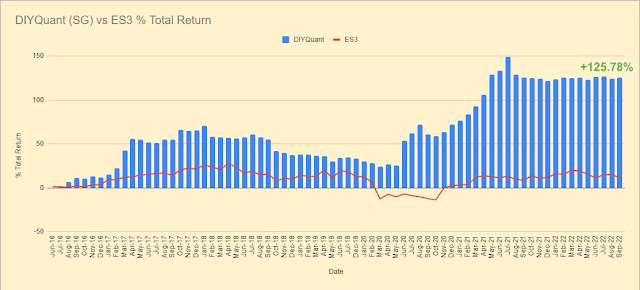

For September, my SG portfolio actually rose 0.68% while the STI ETF I used to benchmark (SGX:ES3) fell 2.37%. This is thanks to Moya Asis (SGX:5WE) that got a privatization offer and I profited 45% from the price jump (refer to this post). This has helped to buffer the losses from some other stocks. Also thanks to the portfolio being generally overweight in cash which also help to cushion some of the fall. YTD return increased to +1.74%. Total portfolio return since inception is now +125.78% while ES3 is merely +35.85%.

Join us in our quest for abnormal returns. Get started today >>

Below is the chart showing the SG portfolio's monthly return since inception.

On US side, things were not as rosy. My portfolio fell 7.27% in September despite being heavyweight in cash. Yet thanks to being heavyweight in cash that the drop is cushioned. But the decline still outperformed SPY which crashed 9.25% in September. So far this year, my portfolio return is -6.38% while SPY was way worst -23.93%. Portfolio total return since inception fell to +103.68%.

while SPY is +91.19%. Again the system beat the benchmark by losing less.

One thing to note also is that so far this year, USD has risen more than 6% against SGD. That means my portfolio gained +6% just by holding USD alone. But of course currency fluctuation is not reflected in the calculation of portfolio return.

Below is the chart showing the US portfolio's monthly return since inception.

With the Fed maintaining its hawkish tone, it will continue to put pressure on the equity market. Still, the same message to everyone. Keep cash, or get trashed.

To know exactly what stocks the system is buying, subscribe to our premium subscription package. You can visit our main page to find out our system's current performance and how the subscription works. Get 45% discount if you sign up now! Or for a start, follow us on Facebook to get notified of all free postings!!

![[Watchlist] US Stocks caught Trending on System's Radar for Week of 17th Sep 2018](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjVlw8ePzHYbUGgNe8-I-gEMvS7StYEclF_E7lAhUHjHAXuTh1bUMXAt6Zg1o0qEFZfwIkS7__E3zVLFnLecU05bRmfsVTIxBqnwAsXocCDYCMCKYT3rXnPacIuEnANSsBQV6kHgPYQa8he/s72-c/stock-market-2616931_640.jpg)

![[Watchlist] US Stocks caught Trending on System's Radar for Week of 27th Aug 2018](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhld7TDTlKp433twtL0Ha0L_Aky2PiMKIJCcjTHgd4gZ0AUcAx1Y0R0c4NkdGA8Zru5eDEU4Mnfa2786NG_5UEfTqI2Hh4GQG6gai8q4XeNDMSlKb51xm-O7VwmhIevASVx62B5IC2drPM4/s72-c/stocklist1.jpeg)

No comments:

Post a Comment