It has been a rough first half year for both local and US markets. Inflation remains at 40 years high. Interest rates shot up like rocket with a rare 75bps rate hike last month and another one possibly coming in July. Gas and petrol prices are at multi-year high. Home loan rates are rising (thankfully I paid off mine). Food cost keeps rising like almost every few weeks, to the point where the shops don't even bother to inform you (they used to stick a note to explain their need to hike prices, nowadays they don't bother anymore). There seems to be nowhere to put your cash to work or hide your stash. Stocks are selling off, bonds are selling off. Money becomes less worthy (a little better off if you keep USD or gold - I love gold). I know of several who got burn by the tech and crypto selloff (one was in Luna). Even those in 60/40 portfolio were not spared...

That was a summary of what happened in H1. Here is the system's performance report:

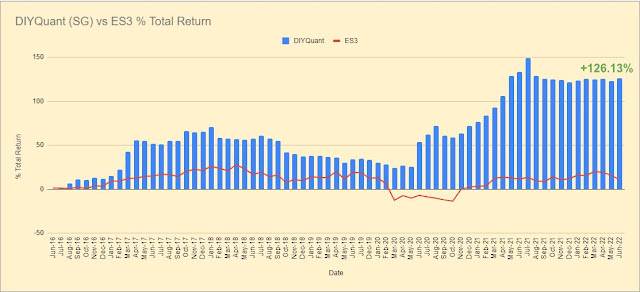

In June, while STI crashed 4.53%, I am relieved my system's SG portfolio actually rose +1.34% despite being heavily in cash. This is thanks to a few stocks in the portfolio that actually went up (eg Dyna-Mac SGX:NO4 +12.50% and Jiutian SGX:C8R +11.38%) despite the bank heavy index sell-off. There is always a rising stock in every kind of market condition. I have finally managed to beat STI for the year with portfolio YTD return at +1.90% while SGX:ES3 (STI ETF I used to benchmark) fell to +0.97%. Portfolio total return since inception rose to +126.13% while ES3 return dropped to +33.27%.

Join us in our quest for abnormal returns. Get started today >>

Below is the chart showing the SG portfolio's monthly return since inception.

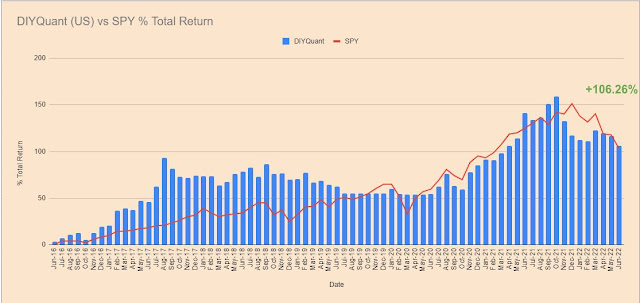

Below is the chart showing the US portfolio's monthly return since inception.

For the past few months, the system has been hoarding lots of cash in the portfolios. This has saved the portfolios from huge drawdowns as the market remains volatile and weak. Moving forward, the message should be the same, keep cash, or get trashed.

To know exactly what stocks the system is buying, subscribe to our premium subscription package. Visit our main page to find out more.

Performance Join as Member

Follow us on Facebook to get notified of all postings!!

![[Watchlist] US Stocks caught Trending on System's Radar for Week of 17th Sep 2018](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjVlw8ePzHYbUGgNe8-I-gEMvS7StYEclF_E7lAhUHjHAXuTh1bUMXAt6Zg1o0qEFZfwIkS7__E3zVLFnLecU05bRmfsVTIxBqnwAsXocCDYCMCKYT3rXnPacIuEnANSsBQV6kHgPYQa8he/s72-c/stock-market-2616931_640.jpg)

![[Watchlist] US Stocks caught Trending on System's Radar for Week of 27th Aug 2018](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhld7TDTlKp433twtL0Ha0L_Aky2PiMKIJCcjTHgd4gZ0AUcAx1Y0R0c4NkdGA8Zru5eDEU4Mnfa2786NG_5UEfTqI2Hh4GQG6gai8q4XeNDMSlKb51xm-O7VwmhIevASVx62B5IC2drPM4/s72-c/stocklist1.jpeg)

No comments:

Post a Comment