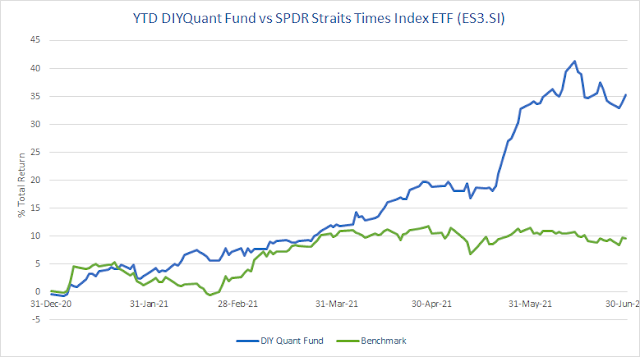

So far this year, my system's portfolio has been doing pretty well in both Singapore and US. Year-to-date return for SG portfolio is +35.32% as compared to +8.90% for SGX:ES3 (benchmark STI ETF). Total return for SG portfolio since inception (Jun 2016) now stands at +133.23% while SGX:ES3 is +27.42%. Here are the returns for each month for 2021. So far this year, every month has been a green month.

January: +2.36%

February: +4.25%

March: +5.04%

April: +7.10%

May: +11.13%

June: +1.84%

For system's yearly performance check out the main page.

To update those who have been following me, I am still holding on to PropNex (SGX:OYY) multi bagger profit which I have bought last year. Still holding to Pan Hong (SGX:P36) as well. In addition, I came to realize that what is driving up a huge part of the profit for the system is those multibagger trades that the system came to pick up. Though the system only allocates about 10-20% per stock, a multibagger will drive the profit up by more than 10% for the whole portfolio! The most you can lose in a single stock is 100%. But the highest you can make per stock is .... the sky is the limit (theoretically). Currently the system is holding a total of 4 multibaggers (only shared with subscribers),

As for US portfolio, Year-to-date return is +30.39% while SPY is +14.87%. Total return for US portfolio (since Jun 2016) is +141.36%. SPY total return is +124.26%. Here are the returns of each month for 2021. Most months are green.

January: +3.42%

February: -0.13%

March: +3.87%

April: +3.85%

May: +3.89%

June: +12.65%

Market turns more volatile after the Fed signals bringing forward the time frame on when it will next raise interest rates (could be as early as 2022!). Expect more volatility ahead as we get closer. But with sound risk management and proper trading plan, the system should be well prepared to protect profit if things turn sour. Stay tuned.

To know exactly what stocks the system is buying, subscribe to our premium subscription package. Visit our main page to find out more.

Performance Join as Member

Like us on Facebook!

![[Watchlist] US Stocks caught Trending on System's Radar for Week of 17th Sep 2018](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjVlw8ePzHYbUGgNe8-I-gEMvS7StYEclF_E7lAhUHjHAXuTh1bUMXAt6Zg1o0qEFZfwIkS7__E3zVLFnLecU05bRmfsVTIxBqnwAsXocCDYCMCKYT3rXnPacIuEnANSsBQV6kHgPYQa8he/s72-c/stock-market-2616931_640.jpg)

![[Watchlist] US Stocks caught Trending on System's Radar for Week of 27th Aug 2018](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhld7TDTlKp433twtL0Ha0L_Aky2PiMKIJCcjTHgd4gZ0AUcAx1Y0R0c4NkdGA8Zru5eDEU4Mnfa2786NG_5UEfTqI2Hh4GQG6gai8q4XeNDMSlKb51xm-O7VwmhIevASVx62B5IC2drPM4/s72-c/stocklist1.jpeg)

No comments:

Post a Comment