How was Apr 2020 like for Singapore market?

April 2020 was an eventful month for those in Singapore. The government introduced the circuit breaker where everyone except those working in essential services were to stay home for a duration of one month (now it has been extended to 2 months). Then there was the oil price crash which resulted in Hin Leong going bust. However, the market was not affect much by it and STI in fact rebounded from the low and gained 6% for the month.

How was the portfolio performance in April 2020?

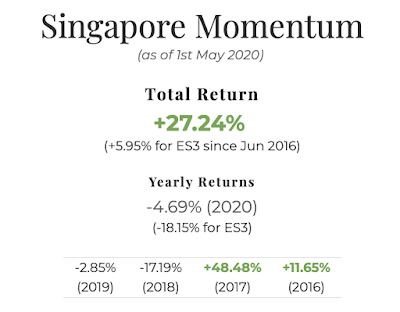

It was not at all eventful for my SG portfolio as, despite the fact that MATA has turned bullish since early April, the system did not manage to load up much due to the high volatility in the market.. The only one stock that the system entered a position in April was Biolodic (SGX:8YY) and it was held for only 4 days but bagged a return of nearly 31% (unfortunately, it only constitute a small fraction of the total capital). The system's SG portfolio return for April was +2.12% while the STI ETF benchmark (SGX:ES3) rose 6%. Year to date return is -4.69% while ES3 is -18.15%, still beating the benchmark by a huge margin. Total return since inception now stood at +27.24%.

Join us in our quest for abnormal returns. Get started today >>

April return: +2.12% (vs ES3: +6.04%)

YTD return: -4.69% (vs ES3: -18.15%)

Total return since inception (since June 2016): +27.24% (vs ES3: +5.95%)

Now that SG overall market has turned bullish, my hope is that the trend will continue to be bullish. Hopefully in May, the system will be able to find more good stocks to load up. Perhaps another Biolidics or Medtech? To know first hand where the market is heading every week, subscribe to our premium subscription package. Visit our main page to find out more.

Get Full Access and follow our system's quest for ABNORMAL returns

Performance Join as Member

Follow our blog on Facebook!

![[Watchlist] US Stocks caught Trending on System's Radar for Week of 17th Sep 2018](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjVlw8ePzHYbUGgNe8-I-gEMvS7StYEclF_E7lAhUHjHAXuTh1bUMXAt6Zg1o0qEFZfwIkS7__E3zVLFnLecU05bRmfsVTIxBqnwAsXocCDYCMCKYT3rXnPacIuEnANSsBQV6kHgPYQa8he/s72-c/stock-market-2616931_640.jpg)

![[Watchlist] US Stocks caught Trending on System's Radar for Week of 27th Aug 2018](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhld7TDTlKp433twtL0Ha0L_Aky2PiMKIJCcjTHgd4gZ0AUcAx1Y0R0c4NkdGA8Zru5eDEU4Mnfa2786NG_5UEfTqI2Hh4GQG6gai8q4XeNDMSlKb51xm-O7VwmhIevASVx62B5IC2drPM4/s72-c/stocklist1.jpeg)

No comments:

Post a Comment