Just last week, US stock market indexes recorded one of the worst plunge in history. S&P500 fell to the low of 2237.44, recording a fall of more than 30% from its all time high. Such plummet is epic and mind blowing. Since 1927, it only happened 6 times. 30% fall makes the price looks cheap. It is, if you compare to the price it had been a few months ago. But is it time for you to jump in? After all it is a decent 30% discount. This post is for the US stock index S&P500. Next I will post one on Straits Times Index (SGX:STI). Follow me via Facebook or Email if you do not want to miss out the post.

Follow us on Facebook!

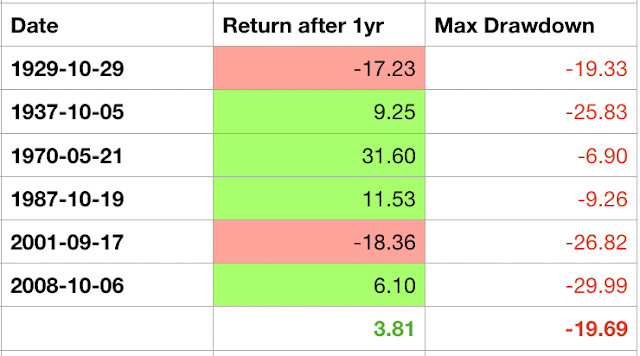

Here is a chart showing the returns and maximum drawdowns of S&P500 after 1 year from a plunge of 30%.

Join us in our quest for abnormal returns. Get started today >>

There are 6 instances of this kind of crash. Wow! When I saw the results for the first time, I was amazed as well. 67% of the time, if you buy in immediately after S&P500 crashed 30%, you will end up losing money. What is worse is that 67% of the time, you would experience a drawdown of more than 15%. It could be as high as 35% drawdown. Average return is a miserable 4.49% but many may not be able to endure the huge drawdown and wait for the reversal up. On the brighter side, there is still a 33% chance of a V-shape recovery like what happened in 1979 and 1987. The returns were awesome for these instances.

Ok the above chart does not that great. So the next sensible thing to do would be to try and see what happens if I were to wait for a few months before buying in after a 30% drop. Here is the chart of the returns after 1 year and a wait of 1 month before buying after a 30% drop.

Here is another chart when I enter after a wait of 6 months.

So it appears that by waiting for a while before entering the market, the average return after 1 year gets better. Maximum drawdown is also milder. Chances of a positive return is 67%. Take note that for the crash in 1929 and 2001, you'll end up losing money in all 3 scenarios due to the fact the recovery took more than a year.

One thing to be cautious is that there are only 6 such scenarios in the past. This means that this result is not statistically significant. You need to form your own judgement on this, perhaps using it with conjunction to some other FA and TA strategies. For me, being more on the conservative side and preserving capital is of utmost importance, I would not jump into the market right after a 30% drop. Or perhaps I could average in... That would be an interesting topic to analyse next. Last but most importantly, please do your own due diligence.

Follow us on Facebook!

Get Full Access and follow our system's quest for ABNORMAL returns

Performance Join as Member

![[Watchlist] US Stocks caught Trending on System's Radar for Week of 17th Sep 2018](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjVlw8ePzHYbUGgNe8-I-gEMvS7StYEclF_E7lAhUHjHAXuTh1bUMXAt6Zg1o0qEFZfwIkS7__E3zVLFnLecU05bRmfsVTIxBqnwAsXocCDYCMCKYT3rXnPacIuEnANSsBQV6kHgPYQa8he/s72-c/stock-market-2616931_640.jpg)

![[Watchlist] US Stocks caught Trending on System's Radar for Week of 27th Aug 2018](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhld7TDTlKp433twtL0Ha0L_Aky2PiMKIJCcjTHgd4gZ0AUcAx1Y0R0c4NkdGA8Zru5eDEU4Mnfa2786NG_5UEfTqI2Hh4GQG6gai8q4XeNDMSlKb51xm-O7VwmhIevASVx62B5IC2drPM4/s72-c/stocklist1.jpeg)

No comments:

Post a Comment