How was March like for Singapore market?

STI didn't make any gain in March as the market whipsawed throughout the month. The slowing down of the global economy particularly China and Europe has been putting pressure on the market. Investors were also spooked by the US Treasury yield curve inversion and the turmoil created by the Brexit. For the month of March, STI only made a minuscule gain of 0.0059%.

How was the portfolio performance in March?

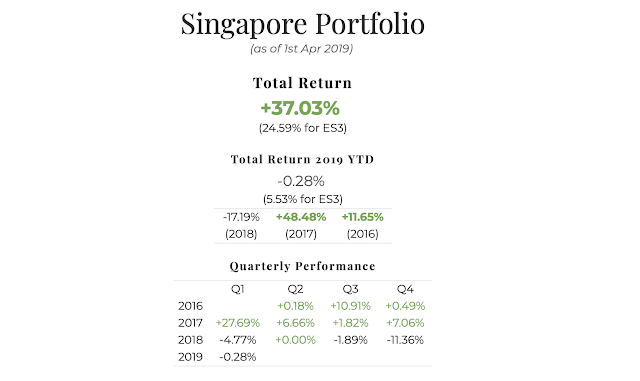

My system's SG portfolio made a slight loss of 0.61% this month as one of the stock in the portfolio Japfa made a 12% loss. Fortunately as the system only allocates a fraction of total capital per stock, losses were kept in check. That's why all this while I kept emphasizing on position sizing and cutting losses which has kept my trading going and protected my profit despite the losing streaks the portfolio has encountered (while waiting for profit to return).Total return since inception fell slightly to +37.03%.

March return: -0.61% (ES3: -0.09%)

Total return since inception (since June 2016): +37.03%.

The system has been bullish from February to March. However, currently system is expecting the SG market to be in a plateau (in other words, whipsawing). The gloomy global economy outlook will continue to pressure the stock market as we enter into April. To know first hand where the market is heading every week, subscribe to our subscription package. Visit our main page to find out more.

Get Full Access and follow our system's quest for ABNORMAL returns

Performance Join as Member

Follow our blog on Facebook!

![[Watchlist] US Stocks caught Trending on System's Radar for Week of 17th Sep 2018](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjVlw8ePzHYbUGgNe8-I-gEMvS7StYEclF_E7lAhUHjHAXuTh1bUMXAt6Zg1o0qEFZfwIkS7__E3zVLFnLecU05bRmfsVTIxBqnwAsXocCDYCMCKYT3rXnPacIuEnANSsBQV6kHgPYQa8he/s72-c/stock-market-2616931_640.jpg)

![[Watchlist] US Stocks caught Trending on System's Radar for Week of 27th Aug 2018](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhld7TDTlKp433twtL0Ha0L_Aky2PiMKIJCcjTHgd4gZ0AUcAx1Y0R0c4NkdGA8Zru5eDEU4Mnfa2786NG_5UEfTqI2Hh4GQG6gai8q4XeNDMSlKb51xm-O7VwmhIevASVx62B5IC2drPM4/s72-c/stocklist1.jpeg)

No comments:

Post a Comment