How was January like for Singapore market?

January 2019 saw Singapore stock market rebounded after a sloppy December. STI made a monthly gain of 3.96% as investors cheered the more dovish tone of the US feds, which is expected not to tighten monetary policy as much this year and the positive progress of the trade talks between US and China. This is truly the January effect at play and for Singapore it is extending into the Chinese New Year effect.

How was the portfolio performance in January?

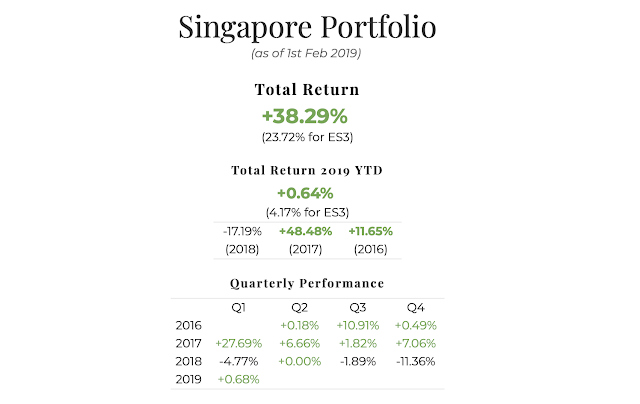

My system's SG portfolio made a slight gain of 0.68% as the system slowly loads up on stocks and reduce cash level after the market strengthened in the early part of the month. Total return since inception increased to +38.29%.

January return: +0.68% (ES3: +4.17%)

Total return since inception (since June 2016): +38.29%.

My greatest concern now is the inversion of yield curve. The yield curve has been slowly flattening since last year. Nobody is talking about it now but it is happening. An inverted yield curve normally precedes recession. For short term, the market is strengthening but I am not sure how long this will last. With concerns regarding weak global economy and slowing China economy, I will continue to invest cautiously moving into February.

Get Full Access and follow our system's quest for ABNORMAL returns

Performance Join as Member

Follow our blog on Facebook!

![[Watchlist] US Stocks caught Trending on System's Radar for Week of 17th Sep 2018](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjVlw8ePzHYbUGgNe8-I-gEMvS7StYEclF_E7lAhUHjHAXuTh1bUMXAt6Zg1o0qEFZfwIkS7__E3zVLFnLecU05bRmfsVTIxBqnwAsXocCDYCMCKYT3rXnPacIuEnANSsBQV6kHgPYQa8he/s72-c/stock-market-2616931_640.jpg)

![[Watchlist] US Stocks caught Trending on System's Radar for Week of 27th Aug 2018](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhld7TDTlKp433twtL0Ha0L_Aky2PiMKIJCcjTHgd4gZ0AUcAx1Y0R0c4NkdGA8Zru5eDEU4Mnfa2786NG_5UEfTqI2Hh4GQG6gai8q4XeNDMSlKb51xm-O7VwmhIevASVx62B5IC2drPM4/s72-c/stocklist1.jpeg)

No comments:

Post a Comment