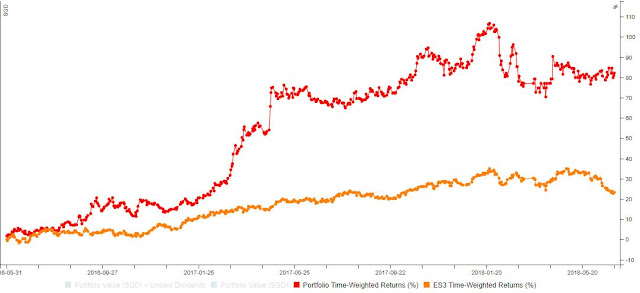

Portfolio time weighted return for 2018Q2 is +2.89%.

Year-to-date time weighted return is still slightly in the red at -1.74% while ES3 (STI ETF) is -2.30% for the year. For most part of June, the system is around 50% in cash.

Overall time weighted return since inception (from June 2016) increased to +83.24%.

As warned in the previous month, SG market is not in a very good shape. In fact, the system has been cautious since the beginning of the year. The number of uptrending stocks is still declining. If you are not careful, you could end up catching falling knives so it is imperative that traders adhere to their trading strategy and strictly follow their cut loss plan to avoid incurring heavy losses.

Take note that as the selling continues, Singapore stocks are moving into the oversold region. This is where things become 'extremely cheap' and a market-wide reversal upward is likely to happen. Remember the post I wrote about the 80/20 rule? (https://diyquantfund.blogspot.com/2018/01/why-am-i-so-concerned-with-proportion.html). It applies to overselling too! I am not sure when exactly it will happen. Shall wait for the system to signal. The system will maintains a cautious outlook for SG for now. Subscribe as a member to catch the reversal.

One the other hand, the system is maintaining short term bullish US. This month, the US portfolio has done rather well. Check out this post at https://diyquantfund.blogspot.com/2018/06/june-2018-portfolio-performance-report.html for more details on the system US portfolio performance.

Performance Chart

Time Weighted Returns by year

Quarterly Returns

| Q1 | Q2 | Q3 | Q4 | |

| 2016 | +2.80% | +12.83% | -0.27% | |

| 2017 | +31.42% | +10.14% | +2.97% | +4.29% |

| 2018 | -5.09% | +2.89% |

Get Full Access and follow our system's quest for ABNORMAL returns

Performance Join as Member

Follow our blog on Facebook!

![[Watchlist] US Stocks caught Trending on System's Radar for Week of 17th Sep 2018](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjVlw8ePzHYbUGgNe8-I-gEMvS7StYEclF_E7lAhUHjHAXuTh1bUMXAt6Zg1o0qEFZfwIkS7__E3zVLFnLecU05bRmfsVTIxBqnwAsXocCDYCMCKYT3rXnPacIuEnANSsBQV6kHgPYQa8he/s72-c/stock-market-2616931_640.jpg)

![[Watchlist] US Stocks caught Trending on System's Radar for Week of 27th Aug 2018](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhld7TDTlKp433twtL0Ha0L_Aky2PiMKIJCcjTHgd4gZ0AUcAx1Y0R0c4NkdGA8Zru5eDEU4Mnfa2786NG_5UEfTqI2Hh4GQG6gai8q4XeNDMSlKb51xm-O7VwmhIevASVx62B5IC2drPM4/s72-c/stocklist1.jpeg)

I was just browsing through the internet looking for some information and came across your blog. I am impressed by the information that you have on this blog. It shows how well you understand this subject. Bookmarked this page, will come back for more.

ReplyDeleteThank you! Glad that you benefited from the information.

Delete