The US indices ended the month of June in a downbeat note with an early rally into mid month that fizzled away towards the end of the month. S&P500 and NASDAQ posted slight monthly gains of merely 0.48% and 0.91% respectively while Dow Jones recorded a drop of 0.59%. The risk of trade war is keeping pressure on the market performance as President Trump continues to slap tariffs on its allies and China.

This month, my system's US portfolio outperformed the S&P500 again, posting a gain of 3.53%. The rally in small cap stocks and basic material sector which the portfolio is currently still overweight in continued to outperform the broader market.

2018Q2 return is an impressive +10.30%.

The portfolio YTD return is now +3.60%.

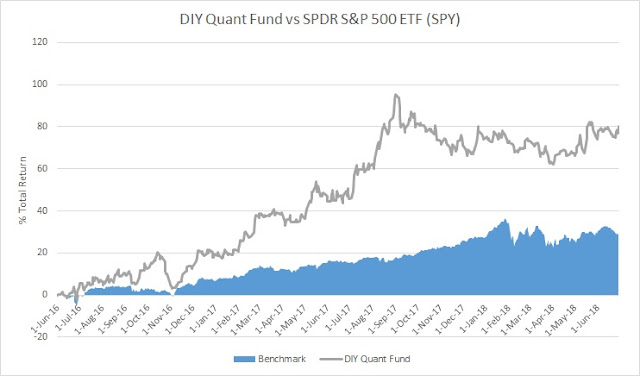

Total return since inception (from June 2016) has increased to +80.36%.

Currently, the system still keeps a short term bullish view of the US market but may change this view in the near future as the upward momentum of the overall market appears to be losing steam. It could be just that the market is going to take a breather or it could lead to a reversal. We'll get to know when the system gives the signal. Subscribe as a member to find out.

Total Return

+80.36%

(34.79% for SPY)

Total Return 2018 YTD

+3.60%

(2.52% for SPY)

| +45.85% (2017) | +19.35% (2016) |

Quarterly Performance

| Q1 | Q2 | Q3 | Q4 | |

| 2016 | +3.36% | +8.87% | +6.07% | |

| 2017 | +16.65% | +4.74% | +24.40% | -4.04% |

| 2018 | -6.07% | +10.30% |

Get Full Access and follow our system's quest for ABNORMAL returns

Performance Join as Member

Follow our blog on Facebook!

![[Watchlist] US Stocks caught Trending on System's Radar for Week of 17th Sep 2018](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjVlw8ePzHYbUGgNe8-I-gEMvS7StYEclF_E7lAhUHjHAXuTh1bUMXAt6Zg1o0qEFZfwIkS7__E3zVLFnLecU05bRmfsVTIxBqnwAsXocCDYCMCKYT3rXnPacIuEnANSsBQV6kHgPYQa8he/s72-c/stock-market-2616931_640.jpg)

![[Watchlist] US Stocks caught Trending on System's Radar for Week of 27th Aug 2018](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhld7TDTlKp433twtL0Ha0L_Aky2PiMKIJCcjTHgd4gZ0AUcAx1Y0R0c4NkdGA8Zru5eDEU4Mnfa2786NG_5UEfTqI2Hh4GQG6gai8q4XeNDMSlKb51xm-O7VwmhIevASVx62B5IC2drPM4/s72-c/stocklist1.jpeg)

No comments:

Post a Comment