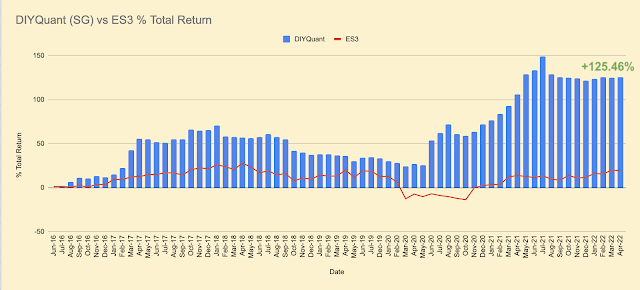

For April, both my SG portfolio and STI remained flat which I think is a good thing as we are not caught in the carnage like other markets. My SG portfolio rose a slight +0.12%. A few stocks like Bumitama Agri SGX:P8Z and Samudera Shipping SGX:S56 which have risen about 15% and 8% respectively have provided support to the portfolio. The STI ETF I used for benchmark (SGX:ES3) fell 0.88%. The easing of the COVI-19 restrictions with the lowering of the DOSCON from orange to yellow provided support for the stock market. The rising interest rates also provided support for the bank heavy index as it is perceived to be good for the banks' earnings. YTD SG portfolio made a modest gain of +1.60% (I made a slight mistake in my YTD calculation last month, this month's value is correct) while ES3 return so far this year is 8.21% which is exceptional. Portfolio total return since inception rose slightly to +125.46% while ES3 return is +41.37%.

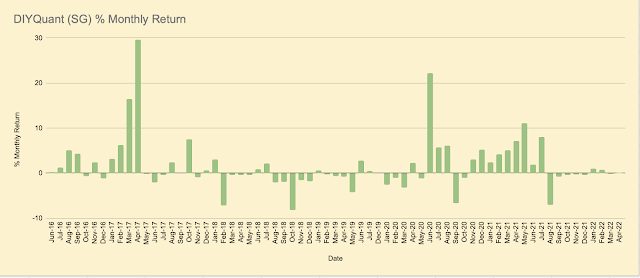

Below is the chart showing the SG portfolio's monthly return since inception.

On the US side, despite the bloodbath experienced by the indexes, my US portfolio managed to sustain only a minor loss of 1.43%. SPY tumbled 8.78%. Once again, my portfolio beat SPY by losing less. US portfolio year-to-date return still remained green at +0.19% (similarly, I made a slight mistake in my YTD calculation last month, this month's value is correct) while SPY fell 12.99%. Total return since inception dropped to +119.53% while SPY return is +118.68% for the same period.

Below is the chart showing the US portfolio's monthly return since inception.

Join us in our quest for abnormal returns. Get started today >>

So far, SG market seems to have good support with the lifting of most of the COVID-19 restrictions and rising interest rates benefiting banks. I see this support will help to reduce the impact of global sell-off due to inflation concerns, rising interest rates, China lockdown and Ukraine war.

And we are going into May where the adage "Sell in May and go away" should not be ignored this time. I believe one should not be fully invested at this time.

To know exactly what stocks the system is buying, subscribe to our premium subscription package. Visit our main page to find out more.

Performance Join as Member

Like us on Facebook!

![[Watchlist] US Stocks caught Trending on System's Radar for Week of 17th Sep 2018](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjVlw8ePzHYbUGgNe8-I-gEMvS7StYEclF_E7lAhUHjHAXuTh1bUMXAt6Zg1o0qEFZfwIkS7__E3zVLFnLecU05bRmfsVTIxBqnwAsXocCDYCMCKYT3rXnPacIuEnANSsBQV6kHgPYQa8he/s72-c/stock-market-2616931_640.jpg)

![[Watchlist] US Stocks caught Trending on System's Radar for Week of 27th Aug 2018](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhld7TDTlKp433twtL0Ha0L_Aky2PiMKIJCcjTHgd4gZ0AUcAx1Y0R0c4NkdGA8Zru5eDEU4Mnfa2786NG_5UEfTqI2Hh4GQG6gai8q4XeNDMSlKb51xm-O7VwmhIevASVx62B5IC2drPM4/s72-c/stocklist1.jpeg)

No comments:

Post a Comment