STI was on steroid last month, gaining about 8% in a single month! With the interest rates rising in the US and with the SG economy already on track for recovery, money appears to be flowing to SG stock market. I believe many SG investors also made profit during this bullish period.

STI ETF (SGX:ES3) which is the benchmark I use to compare against gained +8.03% in March. My SG portfolio managed to gain +5.03%. Year-to-date return rose to +12.08% while ES3 is up +9.52% for the year. Part of the gain is attributed to PropNex whch I am currently sitting on more than 50% unrealized profit. (Clap clap).

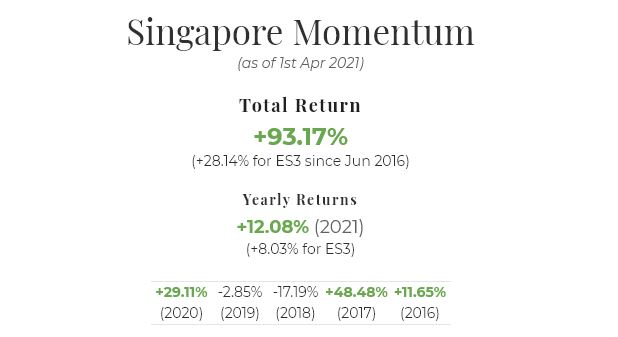

Total return since inception (June 2016) is now +93.17% while ES3 gained +28.14% (incl dividend) for the same period. I am feeling more and more excited as my SG portfolio total return is getting closer and closer to 100%, the multibagger benchmark, 5 years since the system momentum strategy went live.

March return: +5.03% (vs ES3: +8.03%)

YTD return: +12.08% (vs ES3: +9.52%)

YTD return: +12.08% (vs ES3: +9.52%)

Total return since inception (since June 2016): +93.17% (vs ES3: +28.14%)

Join us in our quest for abnormal returns. Get started today >>

SG overall market is still in bullish mode based on the system analysis. With the economy opening up I hope to see more gains coming in the month of April. Stay tuned.

On the US side, things are also still nice and rosy. My US portfolio actually went above 100% at one point in March. But it fell a little and ended the month at +98.53%. This is getting more and more exciting!

To know what stocks the system is buying, subscribe to our premium subscription package. Visit our main page to find out more.

Performance Join as Member

Like us on Facebook!

![[Watchlist] US Stocks caught Trending on System's Radar for Week of 17th Sep 2018](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjVlw8ePzHYbUGgNe8-I-gEMvS7StYEclF_E7lAhUHjHAXuTh1bUMXAt6Zg1o0qEFZfwIkS7__E3zVLFnLecU05bRmfsVTIxBqnwAsXocCDYCMCKYT3rXnPacIuEnANSsBQV6kHgPYQa8he/s72-c/stock-market-2616931_640.jpg)

![[Watchlist] US Stocks caught Trending on System's Radar for Week of 27th Aug 2018](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhld7TDTlKp433twtL0Ha0L_Aky2PiMKIJCcjTHgd4gZ0AUcAx1Y0R0c4NkdGA8Zru5eDEU4Mnfa2786NG_5UEfTqI2Hh4GQG6gai8q4XeNDMSlKb51xm-O7VwmhIevASVx62B5IC2drPM4/s72-c/stocklist1.jpeg)

No comments:

Post a Comment