I am not sure if this rebound will last. It could just be a dead cat bound. Based on the system's analysis, the overall SG market remains tepid with the number of uptrending stocks remained stagnant. In addition, the tech sector and small caps in US appears to be losing steam and these 2 more volatile components tend to lead the market. Nevertheless, there could be a short National Day rally in the coming week. Trade with care and make sure to apply proper risk management.

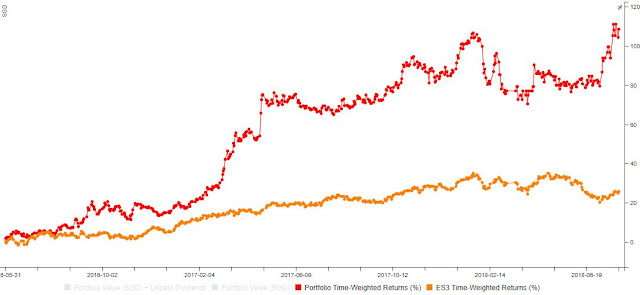

Portfolio time weighted return for July 2018 is +14.50%.

Year-to-date time weighted return has turned green to +12.51% while ES3 (STI ETF) is still red at -0.33% for the year.

Overall time weighted return since inception (from June 2016) increased to +109.81%.

I am glad that despite the tepid market condition, the portfolio managed to achieve the multibagger milestone again after pullback during the February selloff, all thanks to a system that trades systematically with consistency and without emotions.

Performance Chart

screenshot taken stocks.cafe

screenshot taken stocks.cafe

Time Weighted Returns by year

screenshot taken stocks.cafe

screenshot taken stocks.cafe

Quarterly Returns

| Q1 | Q2 | Q3 | Q4 | |

| 2016 | +2.80% | +12.83% | -0.27% | |

| 2017 | +31.42% | +10.14% | +2.97% | +4.29% |

| 2018 | -5.09% | +2.89% | +14.51% |

US portfolio on the other hand did not perform so well this month due to the tech and small cap selloff. You can check out the results here.

Get Full Access and follow our system's quest for ABNORMAL returns

Performance Join as Member

Follow our blog on Facebook!

![[Watchlist] US Stocks caught Trending on System's Radar for Week of 17th Sep 2018](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjVlw8ePzHYbUGgNe8-I-gEMvS7StYEclF_E7lAhUHjHAXuTh1bUMXAt6Zg1o0qEFZfwIkS7__E3zVLFnLecU05bRmfsVTIxBqnwAsXocCDYCMCKYT3rXnPacIuEnANSsBQV6kHgPYQa8he/s72-c/stock-market-2616931_640.jpg)

![[Watchlist] US Stocks caught Trending on System's Radar for Week of 27th Aug 2018](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhld7TDTlKp433twtL0Ha0L_Aky2PiMKIJCcjTHgd4gZ0AUcAx1Y0R0c4NkdGA8Zru5eDEU4Mnfa2786NG_5UEfTqI2Hh4GQG6gai8q4XeNDMSlKb51xm-O7VwmhIevASVx62B5IC2drPM4/s72-c/stocklist1.jpeg)

considered good for Singapore trader with positive result.

ReplyDeleteThanks! Trying my best =)

Delete